Actually, "marine" is a general term that encompasses concepts such as "hull", "cargo", "marine liability" and "offshore". When a ship or other insurable part of it gets damaged during a voyage, while carrying cargo, dispatch, or repair, marine hull insurance provides the compensation. As a result of the perils of the sea, this policy covers all physical losses, liabilities, and expenses incurred by even third parties.

What is Marine Cargo Insurance?

Marine cargo insurance relates to insurance of cargoes while they are being transported (with incidental storage) not only by water (sea/river) but also when they are being

transported by air, road/rail, post parcel, courier or any combination of the above. In a way the word ‘marine’ is a misnomer.

Institute and Non-Institute Cargo Clauses

There is a wide variety of clauses in marine insurance. However the Institute Cargo Clauses and the associated War and Strike clauses form the basis on which coverage is

provided. Though not stated explicitly it is only the physical loss or damage to the goods which is generally the subject matter of insurance.

How Is Sum Insured Determined?

It is a basic principle of insurance law that the assured can only recover from his insurers the loss he suffered: the assured can neither profit from the loss nor be in a worse

position than he was before the loss occurred. This compensation or reimbursement is called indemnity.

Marine policies do not result in perfect indemnity and in fact valued policies are a departure from this basic principle of insurance law.

One of the unique features of marine insurance is that, with rare exceptions, policies are almost always on ‘agreed value’ basis (also called ‘valued’ policies). This means that

the valuation (sum insured) is conclusive and cannot be questioned or ‘opened’ unless there is evidence of fraud or the valuation is so excessive as to make it speculative in nature.

Types of Losses

During the course of the transit of goods from one place/country to another place/country, the goods are exposed to a variety of perils that can lead to a total loss or a partial loss. There could also be expenses incurred to avoid or mitigate a loss from happening. Thus, you may have the following categories of claims/expenses:

Total loss

Constructive total loss

Particular average (partial loss)

General average

Salvage charges

Sue and labour

******

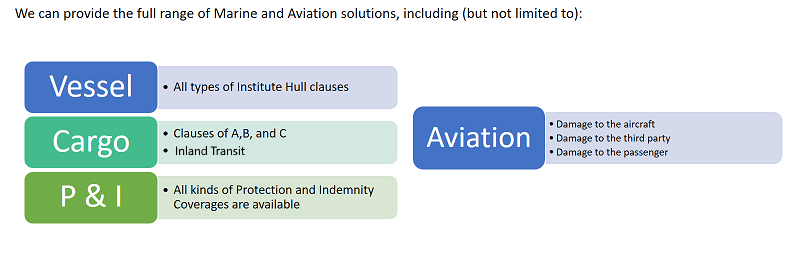

Institute Cargo Clauses A, B and C

Hull insurance: what it means

A hull insurance policy acts as a security blanket for all operational vessels (ships). It is a type of marine insurance that provides coverage for damage to a ship's hull and machinery.

What does Hull Insurance cover?

There are several risks covered by Marine Hull Insurance, including:

- Sea, river, lake, or other navigable water hazards

- Ship or vessel damage, including machinery and equipment damage.

- A fire, burglary, or theft damages or destroys the ship.

- Damage caused by fire, volcanic eruption, earthquakes, lightning, etc.

- The insured vessel causes damage to other boats (third-party liability)

- During maintenance activities, the vessel is damaged.

- Ocean-going vessels are covered worldwide.

- Outsiders stealing from the vessel.

- Jettison

- Piracy

- Objects falling from aircraft, land conveyances, dock, and harbor equipment or installations, or contact with such objects.

What all are not covered under marine hull insurance?

Certain cases are not covered by marine hull insurance.

- Gradual wear & tear of the hull and machinery of a ship.

- Damage caused by nuclear perils.

- Radioactive contamination

- Alcohol-related damage done by crew members.

- Vessel damage caused by an intentional act.

- Terrorist activities damaging the vessel.

- Sailing the vessel in a sea storm after getting a warming order

- Goods overloading

Institute Time Clauses 280, 281 & 344

Cl. 280

Cl. 281

Cl. 344

Proposal form

Cargo Insurance

Hull Insurance